ASC 606 for SaaS Startups: How to Avoid Costly Revenue Recognition Mistakes

Running a SaaS startup is already tough. You’re building your product, acquiring customers, and trying to stay profitable. But here’s something many founders overlook and later regret - revenue recognition.

Abhinav Das M J

Table of content

If you’re not familiar with ASC 606, you’re not alone. Most SaaS founders either don’t know it or don’t apply it correctly. But this accounting standard directly impacts how your business reports growth and handles cash. It could make or break your funding round.

Let’s break it down.

What Are Accounting Standards and Why Do They Matter

Accounting standards are guidelines that tell companies how to report their finances. They make sure every business plays by the same rules, making it easier for investors and regulators to read and trust your numbers.

They are like the grammar rules of financial reporting. Without them, every company would speak a different language.

What is ASC 606

ASC 606 is a revenue recognition standard introduced by the Financial Accounting Standards Board. It tells businesses exactly when and how to report revenue from customers.

The rule is simple in theory. You recognize revenue only when you deliver value to your customer, not just when you receive payment.

In SaaS, where you deal with subscriptions, renewals, onboarding services, and usage-based pricing, this gets complex quickly.

Why It Matters for SaaS Startups

Recognizing revenue too early makes your numbers look stronger than they are. Recognizing it too late makes you look like you’re underperforming.

If your financials don’t match Generally Accepted Accounting Principles, you risk losing investor trust. And if you’re ever audited or acquired, messy revenue reporting will cost you.

SaaS revenue is different from product sales. It unfolds over time. That’s why ASC 606 revenue recognition exists.

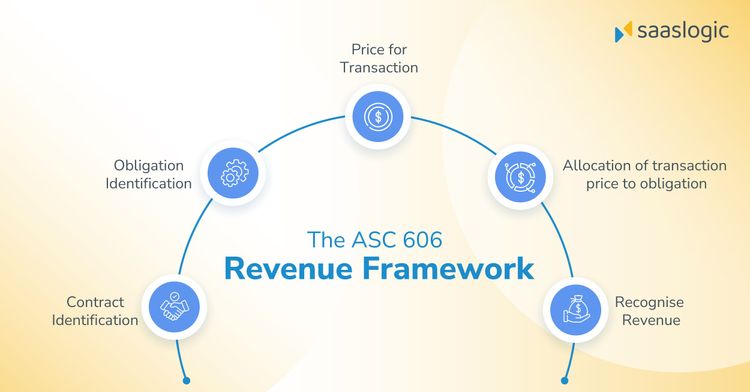

The Five-Step Model of ASC 606 Revenue Recognition

Understanding SaaS revenue recognition is critical for staying compliant and financially accurate. With ASC 606 now the standard, SaaS accounting needs to follow a structured model for how and when to recognize revenue. The goal is to match your earnings with the value you deliver - not just when you get paid. Here’s how the five-step model works in a SaaS context.

1. Identify the Contract

You need a valid agreement with a customer. This could be a signed contract or accepted terms on your signup page.

It must show both parties understand what is being exchanged and that the agreement is enforceable.

2. Identify the Performance Obligations

List out everything your customer is paying for.

Access to your software is one. Onboarding help could be another. If they can be delivered on their own, treat them as separate obligations.

Each obligation needs its own revenue treatment.

3. Determine the Transaction Price

This includes everything the customer pays. That means subscription fees, usage charges, discounts, and even promotional credits.

If your pricing changes based on usage, you’ll need to estimate the total based on expected behavior.

4. Allocate the Price to Each Obligation

If you charge one price for multiple services, break it down. Allocate based on the fair standalone price of each feature or service.

This keeps your revenue clean and defensible.

5. Recognize Revenue When You Deliver Value

Only recognize revenue as the service is delivered.

Monthly subscriptions are recognized month by month. One-time onboarding is recognized after the service is complete. Usage-based pricing is recognized as usage happens.

Common Mistakes SaaS Startups Make

Recognizing Annual Payments All at Once

It’s tempting to book the full payment when a customer signs up for an annual plan. But ASC 606 doesn’t work that way. You haven’t delivered the full value yet, so the revenue must be spread evenly across the contract period. Jumping the gun here distorts your real growth and misleads your investors.

Ignoring Contract Changes

Whenever a customer upgrades, downgrades, or cancels mid-cycle, your original contract changes. So do your performance obligations. If you don’t reallocate the revenue properly, your numbers will go off track. Treat every change like a mini-contract and apply ASC 606 revenue recognition rules again.

Skipping Discount Adjustments

Discounts aren’t just marketing gimmicks. They directly impact your transaction price. If you offer volume discounts, coupons, or refund options, you need to estimate how they affect total revenue. Failing to account for these means you're overstating what you’ve truly earned.

Recording Onboarding Fees Immediately

Some SaaS startups treat onboarding fees as a quick win and recognize them right away. That’s a mistake unless the onboarding service is completely separate from the subscription. If it’s bundled, the revenue should be recognized over the full contract term, just like the subscription itself.

Manually Tracking Everything

Tracking revenue manually might work for your first five customers. But once you start scaling, spreadsheets break. Small errors pile up, version control becomes a nightmare, and audits become painful. If you’re serving more than a handful of clients, automate your billing and revenue recognition.

Not Managing Deferred Revenue

Deferred revenue is a liability, not income. It’s the money you've collected but haven't yet earned. If you don’t manage this correctly, you risk overstating your revenue and understating your obligations. Monitor it closely and reduce it systematically as you fulfill your services.

How to Stay Compliant From the Start

Use the Right Tools

Manual revenue tracking does not scale. A subscription billing platform that follows ASC 606 rules helps automate revenue recognition, handles contract modifications, and keeps deferred revenue accurate. It reduces manual errors and saves your team from financial headaches later.

Standardize Your Contracts

Clarity in contracts is key. Use consistent templates that clearly define what you are delivering and when. This makes it easier to identify performance obligations and apply revenue recognition rules correctly. A well-structured contract also speeds up audits and due diligence.

Keep Sales and Finance Aligned

What your sales team promises affects how your finance team reports revenue. Miscommunication here leads to inaccurate records and restatements. Regular syncs between these teams ensure everyone understands what qualifies as a deliverable and what does not.

Review Your Contracts Often

Your pricing and packaging will evolve as you grow. Every time you introduce a new feature, bundle, or offer custom terms to an enterprise client, you should revisit your contract structure. Revenue allocation logic needs to reflect these changes accurately.

Get Professional Help

ASC 606 is detailed and constantly evolving. A CPA (Certified Public Accountant) who understands SaaS models and subscription revenue can help you apply the standard correctly from the beginning. It’s better to spend on expertise now than clean up accounting messes later.

Final Thoughts

ASC 606 is not just a finance issue. It covers how your entire SaaS business is built and measured.

If you plan to raise money, scale operations, or exit one day, get your revenue recognition right from day one. It protects your credibility, helps you understand your true growth, and prepares you for serious conversations with investors and partners.

For businesses operating on a subscription or SaaS model, recognized revenue plays a crucial role in compliance and forecasting. Saaslogic offers built-in support for recognized revenue reporting. With features that track revenue recognition schedules, deferred revenue, and real-time earned revenue breakdowns, Saaslogic simplifies the accounting process.

Want help staying compliant without slowing down your growth? We’ll be happy to assist.

Abhinav Das M J

Technical Content Writer

Abhinav Das M J is a Senior Technical Writer at Saaslogic with 6 years of experience in developing diverse content formats, including technical blogs, SEO-driven web content, use cases, product guides, and whitepapers. His work spans diverse industries including IT, cybersecurity, healthcare, logistics, finance, and low-code/no-code platforms. With a strong focus on simplifying complex ideas, Abhinav blends technical precision with engaging storytelling to make content both accessible and impactful. Outside of work, he explores creative writing and follows emerging tech trends to continuously refine his craft.

Categories

- Churn Reduction and Customer Retention

- Pricing Strategies and Revenue Models

- Billing, Payments and Invoicing

- Customization and Enterprise Use Cases

- Growth Scale and Business Strategy

- Subscription Management and Optimization

- Technology and Integrations

- Startups and Marketing

- Trends and Thought Leadership

- SaaS Accounting & Compliance